You have no items in your shopping cart.

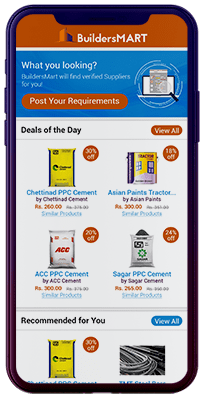

Post Requirement

GST is a tax law that was implemented by the Union Finance Minister and State Finance Ministers of India. It is divided into two systems- Central and State. It has been put into use to replace the indirect taxes that are enforced by the State and Central Government.

GST was at a high rate of 12% previously, for Normal Housing and at 8% for Affordable Housing. However, the Goods and Service Tax(GST) Council had decided to slash the rate from 12 percent to 5 percent for Normal Housing and from 8 percent to 1 percent for Affordable Housing. The actual rate of tax is calculated as the taxable value of the construction project which excludes the cost of the land. Here are essential things that every home buyer should know while buying a construction project.

What is the main difference between the previously implemented and newly revised GST rates?

Besides cutting down the rate of tax on Normal Housing and Affordable Housing, there is no Input Tax Credit (ITC) benefit on the lower tax rates that are now being implemented.

What is the GST rate that is being implemented right now?

Construction projects that are launched after April 1st are eligible for the newly revised GST rate which is 5% for Normal Housing and 1% for Affordable Housing.

What is the GST rate for projects that are already under construction before April 1st?

Homebuyers and Developers with properties on which construction has commenced before 1st April can choose between two options—the older rates that include Input Tax Credit benefits or the newly implemented rate without the addition of ITC benefits.

What are Input Tax Credit benefits?

Input means the amount of money that was spent on building materials, equipment and services that were used for construction, etc. ITC benefits would imply that taxes that were previously paid for availing these services would not be levied to paying taxes again.

What does one mean by Affordable Housing?

Affordable housing is decided on two main factors—the carpet area and pricing. A house or apartment that is valued below Rs.45 lakh would be considered for GST rates of Affordable housing. There are few conditions regarding carpet area requirements in both metro and non-metro areas.

A house having a carpet area of up to 60 square metres will be considered in a metro area while houses with 90 square metres of carpet area will be considered eligible in non-metro areas including villages, towns and non-metro cities.

How does one decide whether a project was under construction as of 31st March or not?

If work on the project was started previously and the certificate of completion is not issued before 31st of March it is considered to be under construction. Even if the house is not occupied yet, it is still considered to be under construction. There is an option to choose old and new rates of GST for such projects.

What tax rate is applicable is half the payment for an under-construction still has to be made after 31st March?

Unless the developer decides to go with the older rates that include ITC benefits, the new lower tax rate will be considered for the rest of the payment.

What is the rate of GST for commercial areas?

The Goods and Service Tax rate for commercial areas is 12 percent however this can be increased to 15 percent if a residential area has a space being used for commercial purposes.

Who is accountable for paying the GST in case of resale of an under-construction unit?

The new owner of the property will be legally responsible for paying the amount for the Goods and Service tax.

What GST rate is applied for the redevelopment of extended areas?

All redevelopment projects have 5 percent GST rate applied to the increased property area.

Who pays GST to the Government?

The builder or developer has to pay GST to the Government as soon as the project is finished or once it is occupied for the very first time. An amount called the reverse charge will also be paid to the Government when the apartment is not booked by the time the completion of project certification is received.

What is reverse charge?

Generally, suppliers are charged tax for the goods they supply however, during reverse charge, the receiver is legally responsible for paying GST, i.e., reversed charging of tax.

Please check out:

6 Security Assurances under a Construction contract

Technically Reviewed by Rajesh Pagadala, MS, Founder & CEO - BuildersMart.

Srujana T